How to Know When it’s Time to Sell Your Agency

Selling a business is a major decision. On occasion, the decision to sell is driven by one factor, such as the principal facing a health concern. For most agency owners, though, the decision is based on a number of factors. In our experience of working with hundreds of agency owners over the years, we’ve come up with a list of key statements to determine when is the right time to sell your insurance agency.

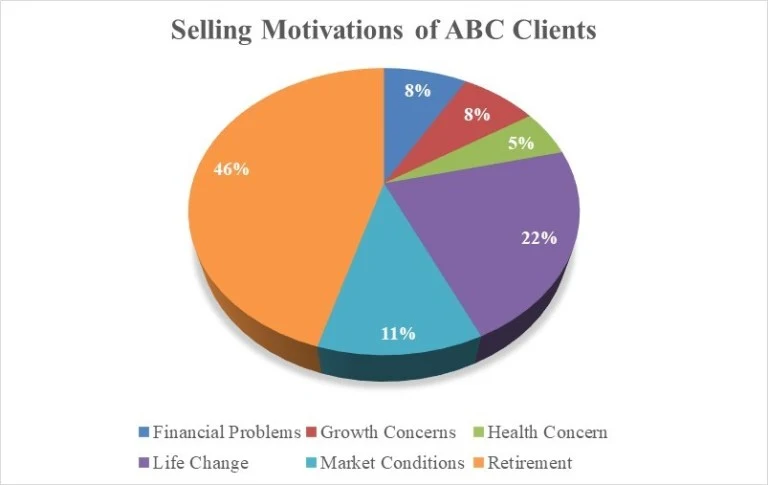

Before I get to the list, though, let me share what motivated our prior clients. I actually took the time to go through the list of all of our prior clients and categorized them by the primary motivating factor for selling their agency. The pie chart below summarizes the information.

Nearly half of our clients hired us because they wanted to sell and retire. Aside from age, this group had no other similarities and spanned all sizes of revenue. Secondary to that is the motivation of desiring a change in life, such as desiring to move, changing careers, or exiting one area of insurance to focus on a different area. The third historic motivator (although 2nd in the last 2 years) was market conditions, agency principals that recognized the business value was peaking. The unique similarity of this group was that the average revenue was in excess of $2M. Agencies in the next two categories, Financial Problems and Growth Concerns, tended to be smaller where the principals struggled with cash flow and scaling. Most in these groups sold to larger organizations and continued working for the buyer. And, of course, we deal with the unfortunate category of principals needing to sell due to a death, personal health concerns or those of a family member. Thankfully, this represented the smallest group.

We know our clients well. In truth, there were typically multiple factors at play in their decision. Some that I rated as being driven by Retirement could have been grouped with Life Change. As such, assume my estimates are accurate within 15%. Any bias I might have imposed doesn’t materially change the composition of our clients’ motivations.

So back to the question…

How do you know when it is time to sell your insurance agency?

We have composed a list of statements below to help you figure this out. Go through each and answer “yes” or “no” if the statement is accurate for you.

- It’s time to do something different with my life.

- My burning desire to compete has waned.

- I cannot find good agents or CSRs to hire.

- My agency is not growing and will likely decline in value over the coming years.

- I have most of my net worth tied up in the business.

- My children are not interested in, or capable of, taking over the business.

- I have had a health scare, and it’s time to enjoy life while I still can.

- I’m having relationship issues within my family or partnership, which are making the business emotionally draining.

- I want to exit the agency on my terms and from a position of strength.

- I have been approached by buyers, and the market is hot for selling.

Total up the number of “yes” responses.

¤ If you scored 0 to 3, then it’s not time for you to exit. Buckle down and grow the business.

¤ If you scored 4 to 6, now may not be the time, but you would benefit from a discussion about exit planning.

¤ If you scored 7 to 8, your transition phase is coming soon. It’s time to get the business evaluated and develop an exit plan.

¤ If you scored 9 to 10, then you are past due for exiting the business. I strongly encourage you to proceed before the business value declines significantly.

The Bottom Line

You have to honestly evaluate your personal motivations and the conditions around you. If you have a defined perpetuation plan or still have the mojo in the business, great! Keep going! If not, then it’s time to look at your options and start planning for the next phase. As I have discussed before, when the business starts to go downhill, the loss in equity can quickly surpass the benefit of the income stream so doing nothing is going to cost you.

Feel free to give me a call if you have any questions. Thank you.

Experts in insurance distribution business valuation, sale, and acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us