How an M&A Advisor Earns Their Fee: A Tale of Two Deals

One of our clients this last year came to us after a failed transaction with a buyer that had approached them. This particular client had negotiated a 7-figure sale price with the buyer and started the process of trying to get the deal done. To keep the story short, we’ll just say that six months later, the deal was still dragging out, and the buyer had attempted to renegotiate the terms for no fault of the seller. Reaching their wit’s end, the client went online to find someone to help, found our website, and called us.

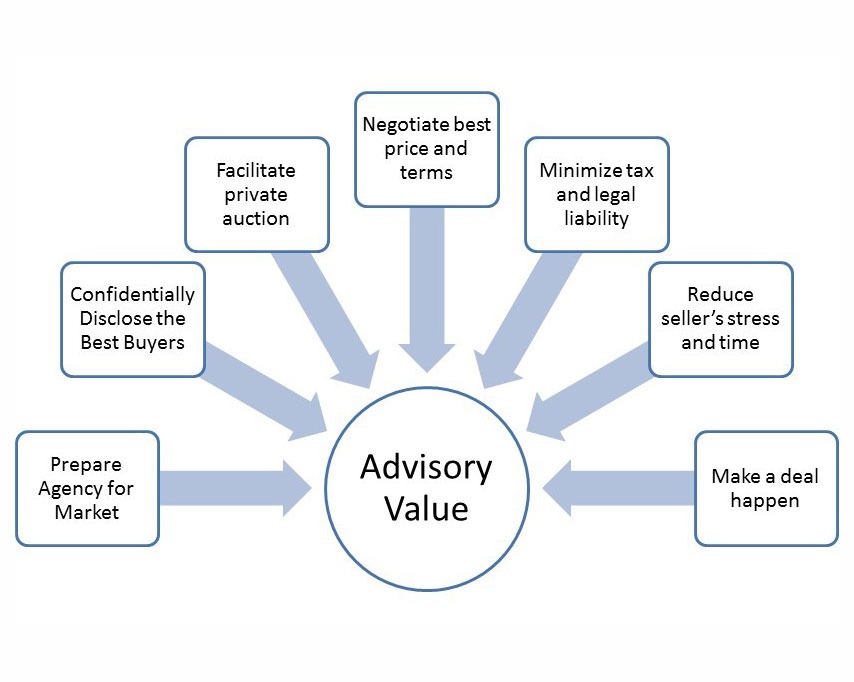

We performed a complimentary valuation for them to assess the market value and learn more about the agency, and then moved forward with representing them. Through our efforts, we narrowed the buyer pool down to three very qualified, strategic buyers, negotiated the highest offer possible and yielded our client 20% more in purchase price than they had done with their own buyer with more cash at closing than the purchase price their buyer had initially offered. We also closed the sale within 45 days from the offer being signed. It was a win-win-win all around. Our client and the buyer were extremely happy with the transaction, and our fee was easily earned by the additional purchase price that we had secured the client, which was 3 x our fee. This also doesn’t factor in the value of removing much of the time and stress related to getting to the closing table.

This is a pretty common occurrence for us. One of our other transactions last year occurred under very similar terms. The seller had been approached by a national brokerage about selling. The buyer recommended that the owner contact a specific national M&A firm to represent him, which he did. The M&A firm did not bring in other buyers but only accepted an offer from the initial one that made the recommendation. The seller didn’t like the proposed terms, and the buyer wouldn’t negotiate, so many months later, he called me. I reached out to a number of larger, strategic buyers to talk general terms, and we closed on the sale of the agency within a few months with the sale price and terms that the owner wanted. The buyer ended up with a platform operation in a new market area, and the seller decided to stay on in a leadership role for the buyer. Another win-win.

I have discussed these types of stories before. The reason this scenario is common is that (1) most agency owners are contacted by would-be buyers or brokers that have a “qualified buyer” regularly, or (2) know peers that likely would have an interest in buying their agency, and (3) do not want to pay a fee to an intermediary to facilitate the sale of their agency. So the agency owner takes the path of the least initial resistance. The challenge is that buyers are a mixed bag of nuts, so to speak. Different buyers will see different value in a particular agency, each will have varying degrees of risk tolerance, and many are simply not qualified prospects and/or don’t know how to pull off an acquisition. And then, of course, many brokers are simply looking to introduce owners to buyers in the hopes that they can get paid if one of the buyers pulls a deal off (like throwing spaghetti against the wall to see if it sticks).

The biggest threat to selling an agency isn’t necessarily a breach in confidentiality; it’s becoming burned out on trying to sell your agency and giving up. Hiring an advisor to represent you will dramatically reduce that risk and an experienced and professional M&A advisor will earn their fee a number of ways without subtracting from your sale proceeds. Your agency is likely your most valuable asset. Avoid the risk and headache of going it alone and hire professional representation.

“I want to thank you for helping us sell our agency. Everyone at your firm is very professional and knowledgeable.

I was impressed by the Valuation Report and analysis that you did on our agency. The numbers were spot on and I know that the report helped us get top dollar for our agency.

I appreciate the fact that you held our hand and walked us through the entire process. From beginning to end the timeline that you set out evolved just like you said it would. It’s amazing that from beginning to end the entire process took only about two months.

Everything went very smoothly because of your expertise and experience in evaluating, buying and selling agencies. I have already given your name to agency owners that are friends of mine and I know you will help them maximize the value of their agency.

Thank you all very much for all your help and guidance.”

Yours truly,

Israel, Former Owner, Weston Financial Group, Inc.

Experts in insurance distribution business valuation, sale, and acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us