If you can’t Grow, it might be time to Go!

When agency revenues start to fall year-over-year, there is usually a reason. Sometimes the trend can be reversed, such as if it is tied to an economic cycle, but quite often the downward trend is unstoppable. In our experience, a steady decline in the business is typically an indicator that one or more of the agency principals are spending less time running the business. The enthusiasm and competitiveness that perhaps once drove growth in the business has waned.

What starts off as a flat lining of growth can quickly evolve into a death spiral since contingency income and loss experiences are tied to growth. A decrease in revenue then translates to a decline in profitability, which triggers a reduction in operating expense such as payroll and marketing, which then fuels the cycle. In physics, this is known as Newton’s 2nd law of motion. To overcome it would require applying Newton’s 3rd law, wherein you need a sizeable force to overcome the downward trajectory. We have yet to see this trend ever reversed, even after having evaluated over 1,000 agencies across the country.

What we have observed – many times – is agencies dropping 30% or more of revenue over the course a short period of time before the owner finally recognized that it was time to sell. The lack of earlier action stems from the mindset that an insurance book of business is like an annuity, providing a steady stream of income over many years. The comparison is actually far more accurate than I think most agents realize. With an annuity, you trade an asset (i.e. cash) for a passive income stream with a low return. Once an agency owner slows down and starts to treat the business like a passive income stream, the asset (i.e. the agency) begins to deplete in value and the rate of return drops.

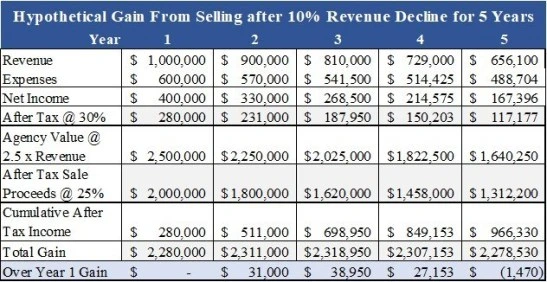

Let’s look at an example of an agency that starts at $1M of revenue. We’ll make a few assumptions for simplicity:

- The value is 2.5 x revenue – likely an overstatement by year 5 given the projected growth trend.

- Profitability, before the owner’s salary and perks, is 40% of revenue in year 1.

- The owner’s effective tax rate, from payroll and income taxes, is 30%.

- The tax rate on a sale of the agency would be 20%.

- The revenue declines 10% per year but expenses only decrease 5% per year, neither of which are unrealistic when an owner isn’t devoting his/her full attention to the business.

Under the above scenario, the owner’s net gain if he/she sold the business after year 1 would be $2,280,000. If he/she sold the business after year 5, his/her total gain after taxes and having held the business for 5 years is $2,278,530. So, in effect, the owner had ZERO additional gain from owning the agency another 4 years. Furthermore, had the owner invested the $2.28M after year 1 and retired, he/she would likely have been able to earn over $100k per year on the investment AND spent time doing something more enjoyable. Let me repeat that, you would be working another 4 years with no financial benefit for dealing with all the headaches and risks associated with running the business. That’s not a good return on your time!

There are a number of unexpected ways the death spiral can be triggered too, aside from an owner’s diminished interest in the business. These could include the loss of one or more key accounts, the loss of a key producer, a carrier cutting compensation, non-renewing a book of business or becoming insolvent, a recession, or an agency taking on too much debt. Whatever the cause, when you are facing strong head winds, staying the course may not be the best plan of action for you, your family or your business associates.

When is the best time to sell?

In an ideal world, you want to sell on a high note when the agency is growing and performing well. As noted in the March 2018 Marshberry Counterpoint, agencies that are growing command a higher purchase price multiple, in their example it was 32% higher, than those that are flat and declining. Buyers are purchasing the future income of the agency, so clearly a growing business will have more value in the future than one that is shrinking. I am not suggesting that every growing agency should sell, just that any owner within a 3 to 5 year time frame from expecting to sell needs to weigh the risk of holding on too long.

To the topic at hand, if your agency is shrinking year-over-year then you probably need to sell. In today’s market, every $1 of lost revenue translates to agency-value-with-revenue-decline $2 to $4 dollars of value. Yes, you are making an income holding on, but the loss of value due to the decline will quickly surpass the value of the income stream. In most cases, buyers will be interested in keeping you on after a sale, which, in addition to the investment income from the sale proceeds, could help sustain you until you are ready for retirement or something new.

I know this may not be the most pleasant of topics for those for whom this article applies. We have seen this trend happen over and over again. If your revenues are on a steady decline, then you must act. Inaction is your worst enemy. If you can not reverse the momentum, either by lack of motivation or resources, then sell now because your equity will only continue to shrink over time.

My last recommendation is to get a valuation performed of the agency regularly. An outsider can evaluate your business objectively, help you weigh your options and keep you abreast of what is happening across the industry and in the marketplace.

Experts in insurance distribution business valuation, sale, and acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us