The Value of Customer Retention

When it comes to agency valuations, agency owners often ask us questions like, “How is the value of our years in business, our reputation, our organic growth, or our customer retention rate factored into the analysis?”

The simple answer is that all aspects, if valuable, contribute to the economic performance of an agency. Let’s consider customer retention.

What to Know About Insurance Customer Retention

According to some sources, the insurance industry has the highest customer acquisition cost (CAC). I assume the sources are talking about CAC as a percent of first year revenue. As a percentage of lifetime revenue, the CAC is probably not much different than other industries. Nevertheless, there are a lot of different models in the industry for acquiring customers – direct marketing, lead purchasing, referral development, producers, etc. When you break it down, the acquisition cost is likely 75-100% of the first year’s revenue – which is less than 20% of the lifetime revenue. I suggest that because the average agency using a marketing-driven model (e.g. personal lines) is spending 3-6% of revenue to replace roughly 10-20% of lost business (e.g. 5%/15% = 33%). Agencies using a producer-driven model, typically spend 40-50% on the first year’s commission. In addition to those acquisition costs are the salaries and bonuses paid to CSRs involved in sales, so adding it all up likely puts the CAC in the range of 75-100% of the first year’s revenue.

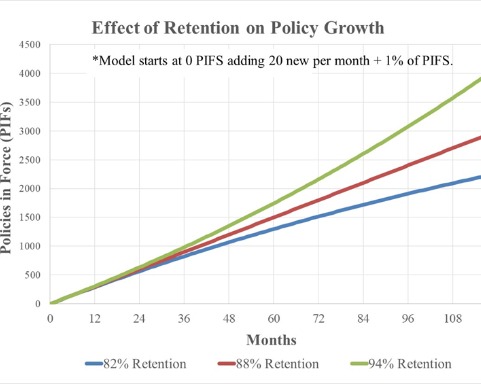

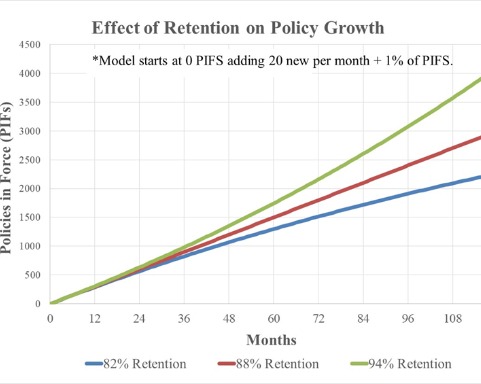

Agency principals understand that retention is important, but I don’t believe that many of them necessarily think about the value of improving retention. I ran some simple modeling to demonstrate the impact of retention over 10 years.

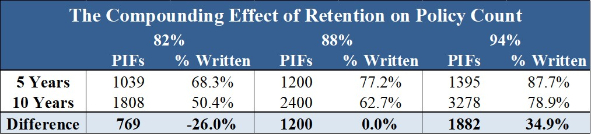

The chart below shows policy growth assuming starting at 0 policies and writing 20 new policies per month while maintaining three different levels of retention. I added a growth variable of +1% based on the policies in-force since the number of sales should increase with the size of the agency. I chose to model this on policy growth because then we don’t have to think about premium, rate increases, carrier commission rates, or such other factors. I used 88% retention, the industry average for standard P&C agencies, as a benchmark and then +/- 6% for comparison. One thing is obvious from the model: increasing retention has a compounding effect over time.

Compared to the 88% retention benchmark, dropping down to 82% yields 13% fewer policies after 5 years and 25% fewer after 10 years. Increasing to 94% retention yields 16% more policies after 5 years and an astounding 37% more after 10 years. Based on the modeling, maintaining an 88% retention would leave the agency with 62.7% of the business that was written over a 10-year period. Dropping down to 82% retention leaves the agency with 50.4% of the business written. Averaging a 94% retention over 10 years yields 78.9% of the policies written still being on the books. Quite a dramatic difference for relatively small changes in retention!

The effect of cross-selling and revenue per policy are important variables to consider in your growth strategy but these have linear correlations to growth. For example, if the agency sold 1.5 policies per new customer, then the model would run at initially adding 30 policies per month and end with a 50% higher policy count after 10 years because the agency sold 50% more policies per month. Again though, increasing retention compounds growth over time.

The Economic Value of Retention

Going back to the original question about how retention is factored in agency valuations, the surprising answer is it plays a very minor role in the value multiple. Whether your agency is at 85% or 90% retention, buyers focus on the big picture: revenue, revenue growth, profitability and type of business written. The value of retention shows in performance over time – higher retention feeds into higher revenue growth and, typically, higher profitability. All other things being equal, an agency with higher retention is going to be worth more over time than one with lower retention.

How much more?

Well, that depends on your revenue, revenue growth, profitability and type of business written. Value multiples tend to increase with revenues. They also increase with growth rate. Agencies with over roughly $500k of revenue are valued on an adjusted earnings basis (e.g. pro forma EBITDA) so a higher earnings margin translates to a higher value. When thinking of growth and pro forma EBITDA margin, apply the Rule of 20: ½ Pro Forma EBITDA Margin + Growth Rate = 20%. If you are below this mark, then you should look to improve efficiency. If you are above it, then you are performing better than peers. I’ll delve into the type of business next.

The Golden Goose

We review financials for hundreds of agencies each year. Our statistics reflect three-fourths of them retain 80-88% of their business annually. Less than 5% are sitting at a customer retention rate of 94% or better. Agencies with 94%+ retention are rare. So, what is the secret to higher retention? From my experience, it lies in specialization.

Certainly, agencies can improve retention by cross-selling and providing “better service” (which is really a cliché). To truly enjoy a higher retention though, agencies need to focus on a class of business or policy type and use some common sense when selecting a niche. By specializing, the agency is seen as an expert, gains access to the right markets, creates efficient processes to retain those clients, and develops value-added service and expertise. In specializing, clients are more confident in their agent and stick around longer.

We had a client some years ago that was “the king” of his niche market. Generalists avoided going after his clients because they knew he owned his niche. Clients thought of him as the expert, he built processes to block competition and, as a result, the agency maintained a 98% retention rate. It was also a segment that was served by a select number of companies, i.e. a quasi-captive market. The best part was that he didn’t quite realize how unique the agency was until we went to market and sold it for a ton of money.

The Bottom Line

Yes, higher retention creates a higher agency value, but probably not in the way that you are thinking. Higher retention feeds growth and profitability over time, which in turn creates a more valuable agency. If you want to find “the Golden Goose”, seek out a niche market. Become the go-to expert, build your processes and value-added resources, and watch your agency’s value increase exponentially.

If you have questions about this article or want to discuss the valuation of your agency, contact me.

Posted by: Michael Mensch, Founder and CEO

Direct: (321) 255-1309

Experts in insurance distribution business valuation, sale, and acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us